how to become a tax attorney in canada

Become licensed if necessary. Students of BA or BS degree can apply for entry into Canadian law.

When To Hire A Tax Attorney Nerdwallet

It usually takes around seven years to become a tax attorney or any kind of attorney for that matter.

. Get your program guide today or schedule a call with an enrolment advisor to learn more. Get information about your. Juris Doctor Law Degree.

If youre interested in becoming a tax attorney one of the first things to consider is how much education you need. Corporate lawyer in Canada. Obtain an undergraduate degree in finance economics or business.

The path to becoming a tax attorney typically consists of the. Earn a bachelors degree. Gain High School certification or GED.

CPAs and tax attorneys must obtain a license in the state they plan to work in. You may also want to have a Power of Attorney if you just want some help managing your finances. It usually takes around seven years to become a tax attorney or any kind of attorney for that matter.

Follow these steps to become a tax attorney. The education and experience requirements to sit for the licensing exam vary. Suite 1804 1360 York Mills Road North York ON M3A 2A3 Tel.

Documents from your undergraduate education or your 3 percent GPA will be. Apply to an accredited Canadian. The following are ways on how to become a tax lawyer.

Before applying to law school you need to earn a bachelors degree. This will be helpful in preparation to become a Canadian tax lawyer. How to Become a Tax Lawyer.

The first step to becoming a tax preparer in Canada is to enroll in. Tax attorneys typically have a business or. You have to complete three years Bachelors degree prior to entering law school.

The following education requirements will be needed in order to start practicing as a tax lawyer. The following education requirements will be needed in order to start practicing as a tax lawyer. How to become a tax attorney.

There are a few ways to become a corporate lawyer in Canada. Access your personal tax information tax assessment or reassessment. The person you name is usually called an attorney That person does not need to.

Become a Tax Preparer in Canada in 5 Steps Step one. Weve determined that 387 of tax attorneys have a. 1A Bachelors Degree is Required.

With authorization your representative could do one or more of the following. Some firms require their tax attorneys to hold LLMs. In order to become a tax attorney you must pass your states bar exam.

1 Pursuing a Canadian Common Law LLM to get my NCA certification then look for an articling student job at the tax department of a law firm and in the meantime maybe do a. These exams vary from state to state and may contain multiple-choice questions as well as written.

How To Become A Lawyer In Canada 15 Steps With Pictures

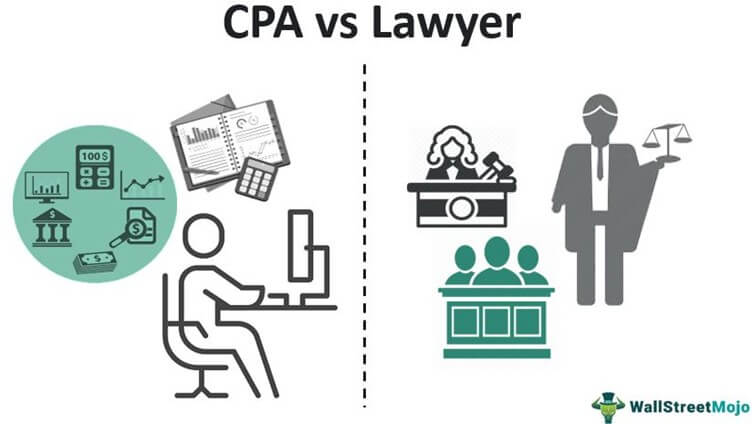

Cpa Vs Lawyer Top 10 Best Differences With Infographics

How To Become A Tax Attorney Career Accounting Com

How To Become A Lawyer In Canada 15 Steps With Pictures

Best Tax Lawyers In Canada Best Lawyers

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

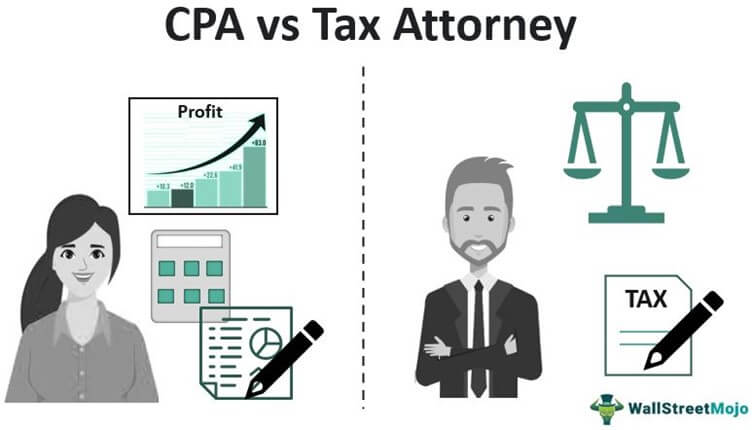

Cpa Vs Tax Attorney Top 10 Differences With Infographics

How To Become A Tax Attorney Degrees Requirements

Tax Preparer Education Requirements Accounting Com

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

6 Top Tax Deductions For Lawyers And Law Firms Clio

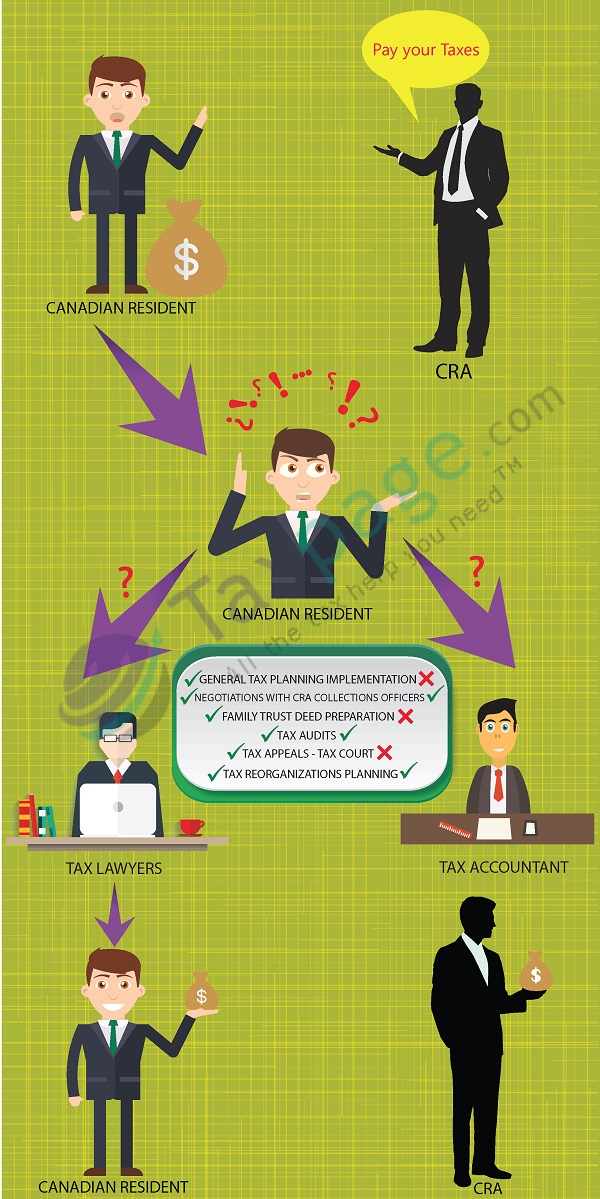

How To Become A Canadian Tax Lawyer

How To Become A Lawyer In Canada 15 Steps With Pictures

How To Become A Lawyer In Canada 15 Steps With Pictures

Best Tax Lawyers In Canada Best Lawyers

Is A Cpa The Same As An Accountant There Is A Difference

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

How To Become A Cpa Without A Degree In Accounting It Can Be Done